Crisil Ratings says, revenue of paper makers to see a decline

According to the IPMA, paper consumption in India will reach 30 million tons by March 2027. And so, on the one hand most paper companies have improved their balance sheet. On the other hand, a Crisil Ratings analysis says, the revenue of paper makers will crumple 8-10% this fiscal. The prediction is: Healthy profits and modest capex spend to support credit risk profiles.

14 Sep 2023 | By Dibyajyoti Sarma

Indian paper manufacturers could see revenue decline 8-10% this fiscal, compared with a steep 30% growth last fiscal, with average realisations expected to soften in keeping with lower raw material prices, and given intense competition. Volume is seen rising 5-7% this fiscal, similar to last fiscal.

Operating margin will remain healthy at 18-19%, ensuring stable cash flow generation. That, and largely modest capex spend undertaken — mostly for debottlenecking and routine modernisation — will help sustain credit risk profiles.

A Crisil Ratings analysis of 87 papermakers, which account for about half of the sector’s revenue, indicates as much.

The packaging paper segment dominates sales in India with a share of 55%. This is followed by writing and printing (W&P) paper at 30%. Newsprint and speciality paper account for the rest. Packaging paper, which comprises kraft paper and duplex board, is used to pack pharmaceuticals, e-commerce goods, consumer durables, fast-moving consumer goods (FMCG) and readymade garments. The education sector and corporates are the major consumers of W&P paper.

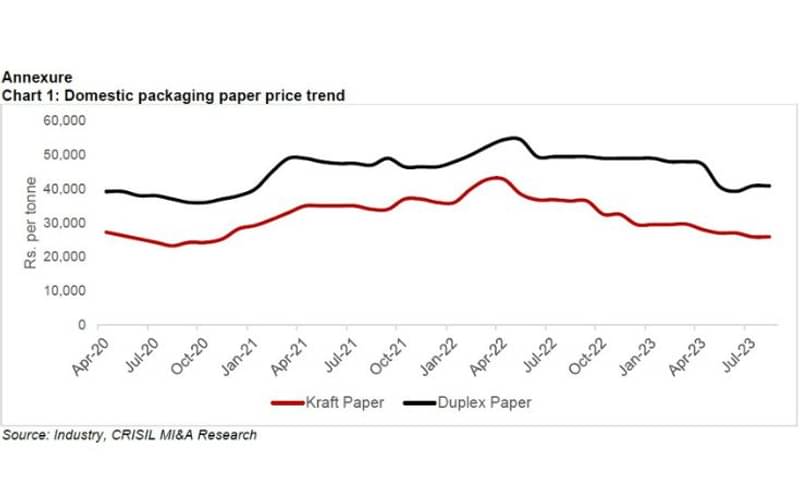

Crisil says there is a decline of 20% for kraft paper and 15% for duplex paper between April-August 2023 from last fiscal’s average

Crisil Ratings expects packaging paper volume to grow 6-8% this fiscal, supported by demand from the pharmaceutical and FMCG sectors. W&P paper volume is seen up a modest 3-5% amid increased digitalisation, and despite being supported by government spending on education and the implementation of the New Education Policy. Besides, demand for W&P paper is expected to rise ahead of the general elections in 2024.

Aditya Jhaver, the director of Crisil Ratings said, "The modest rise in volume in both packaging paper and W&P segments will translate to an overall volume growth of 5-7% this fiscal." Jhaver added, "But this will not offset the steep double-digit price corrections in both segments. Consequently, the paper sector’s revenue is foreseen falling 8-10%."

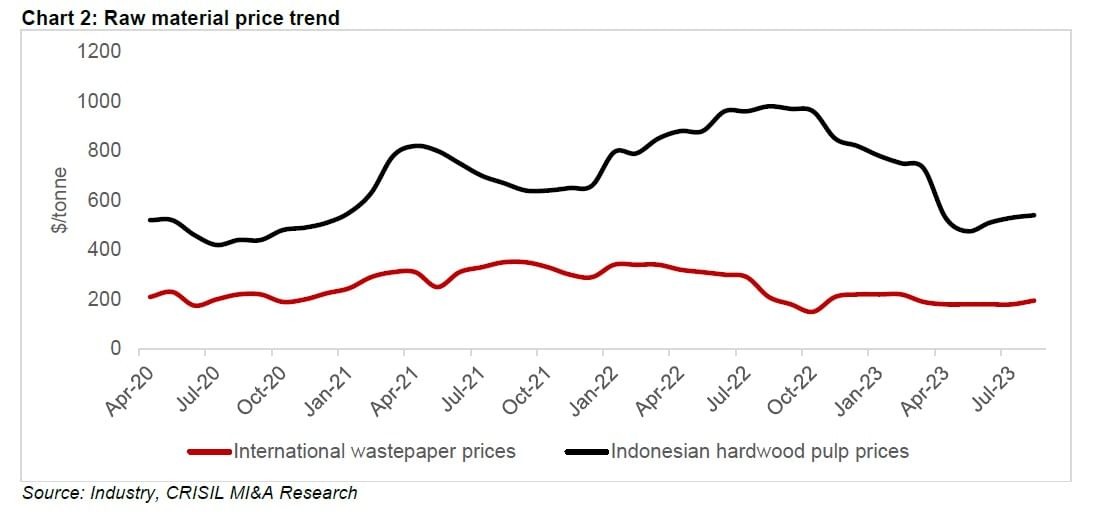

Packaging paper prices (chart 1) are expected to fall ~15%2 on-year this fiscal, following a steep correction in wood pulp and waste paper prices (chart 2), the key raw materials. Imported hardwood pulp prices slid to USD525-550 per tonne between April and August 2023 from $900 per tonne last fiscal, owing to weak demand in the US and Europe, and resolution of supply-chain constraints.

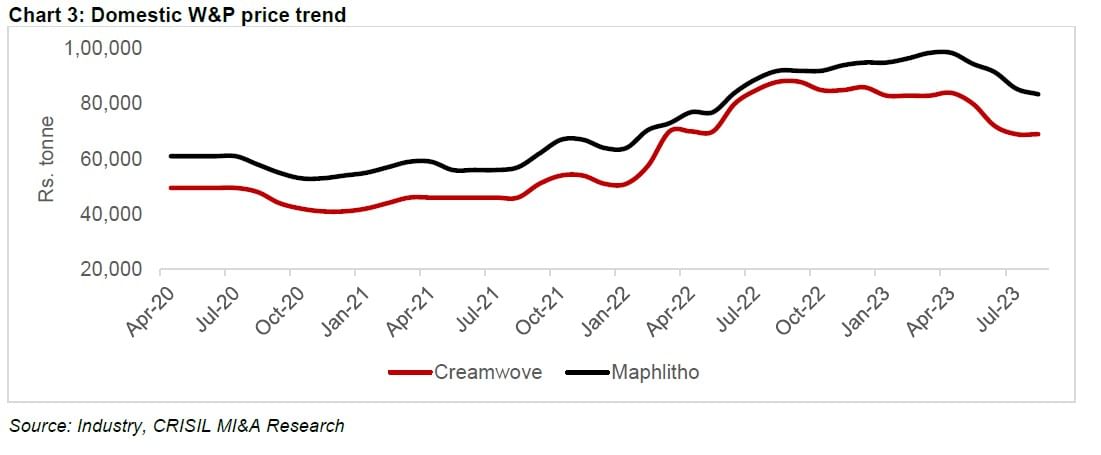

W&P paper prices (chart 3) could slip ~10% on-year this fiscal as domestic makers cut prices to pass on moderation in input cost and to combat domestic competition and cheaper imports from China and east Asia. Realisations had risen 50% last fiscal as consumption resumed, supported by increased demand from the education sector and corporates, while supply-chain issues kept prices of imported inputs elevated.

Operating margin will remain healthy at 18-19% this fiscal, slightly lower than ~20% last fiscal, but better than the pre-pandemic average of 17%, as price corrections have mainly been because of lower input costs. Margins should also benefit from a moderation in the prices of imported coal.

Moderated by 3-5% between April-August 2023 from last fiscal’s average

Joanne Gonsalves, the associate director at Crisil Ratings said, "We expect credit profiles of paper makers to remain largely stable, supported by healthy cash flows and limited addition to debt. Capex intensity is not expected to be significant in the near term, with some large companies currently integrating sizable acquisitions of the recent past." Gonsalves added, "So, capex this fiscal will be largely for debottlenecking and routine modernisation, obviating the need for material debt addition. Debt metrics will thus remain healthy."

Crisil Ratings which is a subsidiary of Crisil and has pioneered the concept of credit rating in India in 1987. It is registered in India as a credit rating agency with the Securities and Exchange Board of India (SEBI).