Global Plastics Treaty — too close yet too far

On 12 February 2025, the Confederation of Indian Industry (CII) hosted the global plastics treaty: INC-5 and the road ahead. The discussion emphasised the need for a balanced approach that safeguards industrial interests while advancing sustainable practices.

06 May 2025 | By Sai Deepthi P

As an observer at the fifth session of the Intergovernmental Negotiating Committee (INC-5) in Busan, CII provided key insights into the ongoing developments of the legally binding global agreement on plastic pollution at the recently organised webinar. It featured key speakers — Swaroop KVR, head of waste management, sustainability and EPR at Srichakra Polyplast, and Bipin Odhekar, head of sustainability, EHS and operations excellence at Marico — who were part of the CII delegation to Busan.

Origins of the treaty

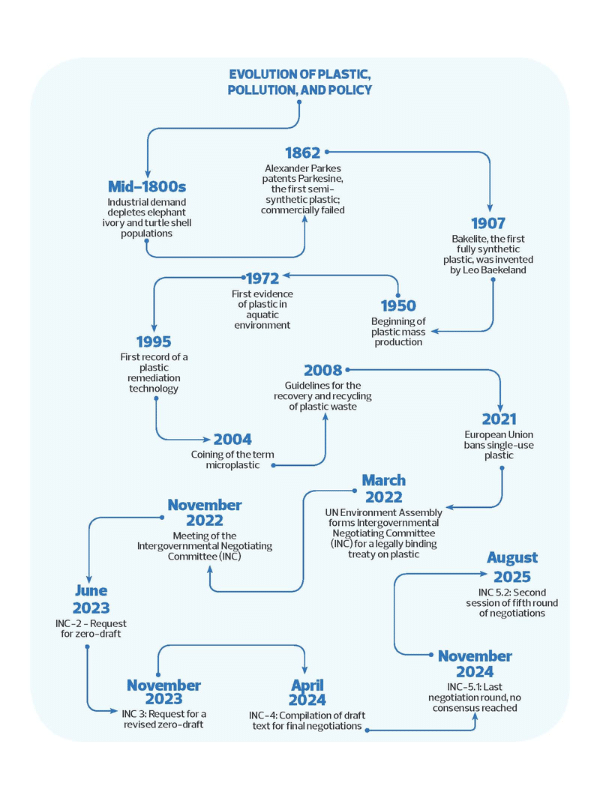

CII’s Shourjomay Chattopadhyay, moderator, stated that plastic pollution has been a focus of global discussions since 2014, with multiple United Nations (UN) resolutions addressing the issue. The INC was formed in 2022 to develop an international, legally binding treaty by 2024, with five rounds of negotiations completed.

What is the INC-5?

The first session of the fifth round of negotiations involved 193 UN member states and observers, including NGOs and industry representatives, where discussions centred on key treaty elements of the treaty, such as plastic production, waste management, and financial mechanisms.

A revised draft summarising the outcomes released on 1 December 2024 noted that financial mechanisms, supply regulation, and implementation strategies require further deliberation. The Indian delegation emphasised protecting the national industry while supporting responsible plastic management at a feasible pace.

While progress was made, consensus on critical issues remained unresolved, leading to an additional round of negotiations in August this year.

INC-5 and the way forward

Swaroop KVR and Bipin Odhekar noted the complexity of global negotiations and the need for a strategic approach to aligning business interests with environmental goals.

While discussing technology transfer for recycling initiatives, Odhekar stated that there are two approaches: direct technology transfer from other countries and developing indigenous solutions through research and collaboration. India’s regulatory environment may slow external technology adoption unless a strong business case exists.

Swaroop believed that bringing in foreign technologies creates an "outward-looking perspective" and a "dependency" that would "be a blocker for the end of capacity enhancement and economic involvement of the country." He focused on the proposal by the Indian government in one part of the resolution, which pushed for creating a financing mechanism for bringing the technology into India. He said, "I think that's what we really looked at, which helps the Indian ecosystem to build better technologies in place and seek approvals for that kind."

Odhekar added to the discussion, stating, "Even though you have very good technology or machines that are coming in, a lot of things are dependent on the in-feed stock. It is my observation that the consistency of the in-feed stocks is still a big challenge for us. The focus on both is equally important as they go hand-in-hand. We should also be in a position to utilise the technology."

Chemical recycling was also discussed, as it remains a topic of debate, with varying perspectives on its feasibility and sustainability. However, the treaty does not specify recycling methods; it only provides a broad framework, leaving implementation details to individual nations.

Global treaties pave the way

As seen with India’s Extended Producer Responsibility (EPR) regulations, any new treaty will challenge the business-as-usual dynamic. However, greater emphasis on responsible design and use of recycled materials could potentially benefit India’s recycling sector. Odhekar also pushed for industry-led initiatives, saying that while regulations drive compliance, industry-led initiatives can accelerate change by integrating sustainability into core business models.

Both speakers urged collaboration among value-chain partners to foster innovation, knowledge-sharing, and proactive industry goals, such as increasing recycled content in packaging. For instance, Indian companies pioneering recycled plastic usage ahead of EPR regulations have insights to share on processing and quality consistency.

The speakers noted that global mandates and treaties would help formalise segregated waste streams for recycling in developing countries, which are slow when it comes to taking initiatives for recycling and waste management.

In conclusion, the speakers agreed that continued investment in recycling infrastructure and voluntary industry commitments will be key to aligning with global standards.

Marico’s Bipin Odhekar on the sustainability efforts in India

In a follow-up interview Bipin Odhekar explored the practical hurdles of implementing sustainability measures in India

WhatPackaging? (WP?): Why is there a lack of indigenisation when it comes to producing plastic alternatives in India?

Bipin Odhekar (BO): As of now, plastic is the cheapest material. The cost of any alternative is to be seen from the perspective of the affordability of that product in developing countries like India. Even if technologies are available, the transition may take time.

WP?: Is virgin plastic deployed instead of rPET to reduce packaging costs?

BO: Packaging needs certain barrier properties like oxygen transmission ratio or water vapour transmission ratio to protect product integrity. To achieve this, rPET production systems and in-feed stock have to be of high quality. India has fewer capacities for good-quality recycled plastic manufacturing as of now. Therefore, the cost is higher than virgin plastic.

WP?: How feasible is a large-scale shift to sustainable plastic packaging for Indian manufacturers?

BO: Highly feasible. It's happening right now. Huge investments are going into waste segregation and recycling facilities.

WP?: Has the sustainable mission led you to any design innovation in packaging?

BO: Our sustainable packaging program has four targets: dematerialisation, which involves reducing weight and carbon emission every year through design change, eliminating hazardous materials, ensuring 100% recyclability of our packaging material, and using recycled plastic in packaging. We have conducted many successful commercial projects in all four areas. However, all these changes require handholding at the vendor’s end to ensure it's a success.

WP?: Has the sustainability drive triggered a shift in contractual agreements drawn between vendor and client?

BO: At Marico, we run a program called “Samyut” for responsible sourcing to bring sustainability in the supply chain. It is designed in a step-by-step manner, which starts with a code of conduct certification, self-assessment, external assessment, and positive long-term performance. We monitor performance through the mechanisms in place.

WP?: Going forward, what is Marico’s strategy regarding sustainable and green raw material sourcing?

BO: Raw material sourcing has many aspects, especially based on the nature of the material. We have created a code for responsible sourcing. We also educate our suppliers on code and drive change.