Report says, cosmetic packaging adopts to the shift in consumer behaviour

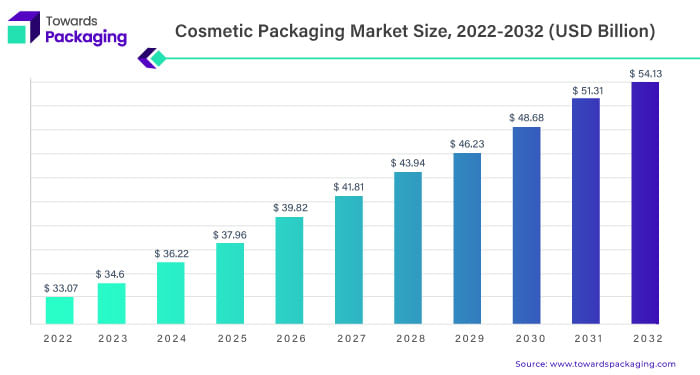

A recent study published by Towards Packaging, states that the cosmetic packaging market is estimated to grow from USD 33.07 billion in 2022, to USD 54.13 billion by 2032 at 4.5% CAGR (2023-2032)

18 Oct 2023 | By Disha Chakraborty

In the current business landscape, companies depend on cutting-edge cosmetic and personal care packaging and advertising strategies to capture the interest of consumers. The modern consumer seeks easily transportable, compact, convenient, and environmentally-friendly products. The choice of packaging material impacts the product's overall style, boosts demand, and enhances its attractiveness. These factors directly influence the market value of the product.

The continuous development of diverse packaging styles, coupled with ongoing innovations in packaging technology, plays a significant role in driving the growth of the cosmetic packaging market. Additionally, emerging economies present growth opportunities for cosmetic products. This is possible due to improvements in disposable income, increased awareness regarding personal care, evolving lifestyles, and the introduction of innovative designs such as sprays and sticks.

Each year, the personal care and beauty industry produces a staggering 120 billion units of packaging globally, posing a significant concern for environmentalists due to the lack of recyclability of most plastic containers. As a result, consumers are now faced with many choices for each product they wish to purchase.

Eco-packaging innovations: Driving change in the cosmetic industry

In light of the increasing environmental concerns, consumers are becoming more conscious of the impact of product packaging.

Effective waste management is now urgent as it directly affects the environment, quality of life, human health, ecological systems, and biodiversity. Emphasising eco-friendly packaging and implementing sustainable practices are crucial in addressing environmental challenges and promoting a better future for all.

The shift in consumer preferences towards green consumption has compelled manufacturers to adapt and align their practices with the new demands and tastes of environmentally conscious customers.

Green living and green consumption have gained popularity in many countries worldwide, particularly in developed nations, and are now spreading to middle-income and higher-income developing countries. This is seen as a practical implementation of sustainable consumption aimed at reducing society's environmental impact. By embracing eco-friendly practices and products, individuals and businesses contribute to the collective effort to create a more sustainable and environmentally responsible future.

In the current trend of green consumption, environmentally-friendly products have taken priority and are now regarded as a hallmark of high-quality products and services. In the past, consumers had limited choices and were often limited to plastic brushes and makeup tools. However, now, bamboo and wooden beauty tools have gained prominence and are available in supermarket chains.

Many packaging solutions are designed to be green, recyclable, or biodegradable, aligning with the growing demand for sustainable and eco-friendly options. This transformation reflects the changing values of consumers seeking products that contribute to environmental preservation and minimise their ecological footprint. As such, businesses that prioritise eco-conscious practices and offer environmentally friendly alternatives are better positioned to meet the evolving demands of the market.

As the beauty market experiences an influx of new brands and products, the pursuit of innovation, efficient packaging solutions, and the desire for product differentiation are factors contributing to market expansion

Digital trends redefining beauty

Social media and online shopping have revolutionised the perception of product and shipping packaging. In the current digital landscape, individuals have easy access to images and information about a product's packaging and unique features, regardless of location.

To succeed in this digital era, it has become crucial for packaging to have a "wow factor" that impresses customers when they unwrap the product. The unboxing experience has gained importance, as it is often shared on social media platforms, influencing potential customers and creating a ripple effect of brand awareness.

As a result, packaging companies are focused on product development that caters to traditional needs and considers its potential impact on social media platforms. The goal is to create aesthetically pleasing, and shareable packaging. By considering the social media impact of packaging, businesses can leverage the power of digital marketing and maximise their reach in the interconnected online world.

Consumer perception about holographic cosmetic closures

One prominent cosmetic packaging design trend in 2022 is holographic or iridescent packaging. Designers incorporate shiny, multi-coloured metallic elements, excellent graphics, and black or white backgrounds to create an edgy and captivating vibe. This trend aims to appeal to consumers seeking visually striking and modern packaging aesthetics.

Cosmetic manufacturers are exploring ways to provide a more immersive experience for customers. They use caps and closures as a customisable extension of their package design identity. These caps not only maintain the integrity of the product but also make it easier for consumers to use the products effectively. Packaging solution providers are also integrating ergonomic designs into these caps, adding new functionalities to the existing packaging.

Pairing applicators and cosmetic closures has become a common practice among manufacturers. Click and close caps are gaining popularity as they provide an audible assurance of a secure closure. Additionally, there is a growing trend of incorporating magnets into closures, particularly in luxury skincare packaging.

Navigating cosmetic packaging trends

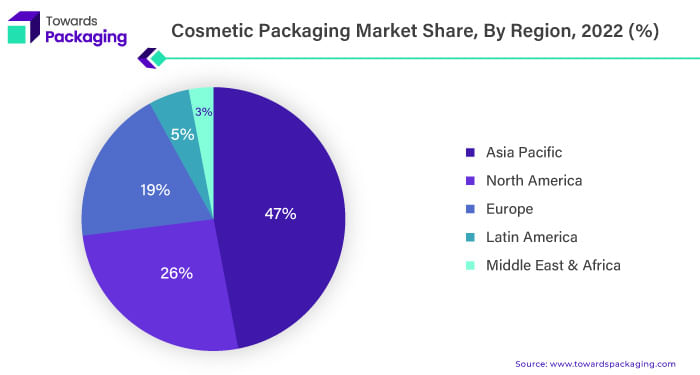

As of the latest data, the Asia Pacific beauty care products market was valued at USD 16.8 billion, with China accounting for more than three-fifths of this total. China is the world's second-largest beauty care products market after the United States.

In May 2022, Carlyle, a global investment firm, disclosed its decision to acquire a complete ownership stake of 100% in HCP Packaging, one of the leaders in the cosmetic packaging sector.

Rising disposable incomes are enabling consumers in the region to spend more on cosmetic products, increasing demand for attractive and high-quality packaging. Additionally, the affordability of cosmetic products, especially those packaged in single-use flexible plastics, is driving their popularity among consumers.

Another notable trend is the Asia-Pacific market's growth of paper-based cosmetics packaging. Asian and global brands are introducing products in paper packaging.

Paper-based packaging has extensive application in the cosmetic industry's secondary and tertiary packaging segments. However, given the predominant water content of cosmetic formulations, typically 70% to 95%, paper is not conventionally utilised as the primary packaging material. Even so, many companies are introducing primary packaging solutions using paper as their base material.

In November 2021, Wow Skin Science launched its Vitamin C Face Wash, featuring eco-friendly paper tube packaging - marking a departure from conventional packaging practices. The Forest Stewardship Council certified the chosen paper material, attesting to its sustainable sourcing. Moreover, the packaging exhibits remarkable burst strength and a low COBB value, underscoring its robustness and resilience even in humid environmental conditions.

The Covid-19 is estimated to have caused a decline of 1.08% in the Pacific region market's growth in 2019

The plastic packaging surge: Implications for market growth

In the cosmetics industry, plastic bottles and containers have established themselves as the primary packaging choice, dominating the market for the past five years without significant competition. A National Geographic study revealed a 120-fold increase in the usage of plastic packaging for cosmetics since 1960, underscoring its adoption.

In March 2021, Garnier committed to ceasing the utilisation of virgin plastic in all of its packaging by 2025. Furthermore, the company announced its plan to achieve carbon neutrality across its factories and manufacturing units by the same year. As part of its sustainability initiative, Garnier intends to adopt reusable, recyclable, and compostable materials for all its packaging requirements. By embracing these environmentally friendly packaging solutions under its program, "Garnier Green Beauty," the company envisions saving 37,000 metric tonnes of plastic annually.

The versatility of plastic packaging extends to various personal care products, encompassing cosmetics, toiletries, and more. Particularly, premium cosmetics that contain delicate components such as special oils, vitamins, and herbal compounds necessitate robust protection from light and potential contamination. Additionally, these products demand an extended shelf life, driving the utilisation of flexible and multi-layer barrier plastic packaging films to meet the exacting requirements.

The PP demand has grown, reaching approximately 6.7 million metric tonnes from 2021 to 2022. Concurrently, HDPE and PVC also registered considerable demand, amounting to 2.9 million metric tonnes and 2.8 million metric tonnes, respectively. These figures underscore the market appetite for these plastic resins in various industries and applications during the mentioned time frame.

Comparative analysis

In this arena, players in the cosmetic packaging market include packaging manufacturers such as AptarGroup, Gerresheimer AG, and RPC Group. Often, these manufacturers collaborate with cosmetic brands to provide customised and premium packaging solutions that align with the brand's identity and target audience.

Major players in the global cosmetic packaging market include Albea, HCP Packaging, Amcor, RPC Group, Silgan Holdings, Bemis Company, DS Smith, Graham Packaging Company, Libo Cosmetics, AptarGroup, and Aremix Packaging.