Dasmohapatra: India will capitalise on plastic exports

Sribash Dasmohapatra, the executive chairman of the Plastics Export Promotion Council (Plexconcil) speaks to WhatPackaging? about India’s plastics industry — discusses challenges, opportunities and global aspirations. Dasmohapatra talks about the return of the plastics-export-focussed export exhibition, Plexconnect 2024, which will be held from 7 to 9 June at the Bombay Exhibition Centre (NESCO)

06 May 2024 | By Aditya Ghosalkar

Plastic, an indispensable material in modern life, serves as the backbone of numerous industries, offering versatility and utility like no other. The benefits of plastic packaging are limitless considering the diverse applications, adaptability, durability, and protective qualities of countless packaging solutions.

Sribash Dasmohapatra, the executive director of Plexconcil envisions a transformative journey for Indian plastics, aiming to propel its export value from a modest USD 12-billion to a staggering USD 1-trillion (USD 25-billion by 2027 – globally the market size is about USD 1.3 trillion I think and we have 1.1 per cent market share). This ambitious leap underscores India’s untapped reservoir of opportunities awaiting exploration on the global stage.

Currently, Indian plastics find their way into the markets of 200 countries, with recent endeavours targeting the emerging markets of Central America. Guatemala, Costa Rica, and Mexico emerge as promising hubs, eager to embrace and foster the growth of the plastic industry within their borders. With continuous and unstinted outreach efforts being made by Plexconcil with the support of Indian high commissions and embassies, these ventures symbolise the collaborative efforts driving the expansion of India’s plastic footprint abroad.

India’s plastic industry has experienced a notable surge in exports, particularly during December and January 2024, signalling positive growth amidst fluctuating global economic conditions. This surge reflects not only the resilience of the Indian plastics sector but also the increasing demand for Indian plastic products in international markets.

Key statistics unveil the evolving landscape of Indian plastics, with exports witnessing a steady climb, poised to reach USD 25 billion by 2027. The diverse export portfolio, spanning raw materials, packaging, and consumer products, underscores India’s multifaceted approach to global trade, leveraging strengths across various segments.

In December 2023, India’s plastic exports reached a staggering USD 1.1 billion, marking a substantial 12.7% increase from the previous year. Similarly, in January, the momentum continued with exports surging to USD 916 million, showcasing a 5% rise from 2023. These figures illustrate a consistent upward trend in India’s plastic exports, contributing significantly to the country’s overall merchandise exports.

Dasmohapatra shared that a key driver behind this surge is the diversification of export products. For instance, he said that consumer houseware products witnessed a phenomenal 139 per cent increase in exports, reaching USD 140 million in December 2023 compared to USD 62 million in the previous year. Additionally, exports of FRP and composite products saw a significant 4 per cent increase, reflecting growing demand for a wide range of plastic goods.

Furthermore, India’s plastic packaging exports have a crucial role in this growth, encompassing various categories such as flexible and rigid packaging. Despite a slight decline in plastic film and sheet exports in November, the overall packaging sector remains robust, with substantial exports observed across diverse product categories including plastic film, sacks, fabrics, tarpaulins, and floor coverings.

Yet, beyond numbers, sustainability continues to remain as a central concern in the industry, driven by increasing environmental consciousness worldwide. Recyclability and reusability are now paramount considerations. However, there’s a notable gap between proposed government regulations on recyclability and their actual implementation across various stakeholders in the plastic value chain, including brand owners, recyclers, and converters. Efforts are underway to bridge this divide by raising awareness, enhancing collection methods, and fostering collaboration among stakeholders. India stands out for its higher recycling rate compared to many other countries, leading the charge towards a circular economy. It champions initiatives aimed at educating and empowering consumers to manage waste responsibly.

Meanwhile, amid the promising horizon lie challenges demanding attention and innovation. The high manufacturing costs, particularly the exorbitant electricity tariffs, pose hurdles in India’s journey towards plastic dominance. Unlike counterparts like China, where government support abounds, Indian manufacturers grapple with unfavourable conditions, hindering their competitive edge in the global arena.

Dasmohapatra told WhatPackaging?, “There is immense potential for India’s plastic exports, especially in emerging markets such as Central America. With concerted efforts from industry players and government support, India aims to capitalise on this potential by expanding its presence in promising markets like Guatemala, Costa Rica, Mexico, Honduras, and El Salvador”. Plexconcil eyes at USD 100 million plastics export across Central America in the coming three to four years.

He said, “Strategic initiatives such as foreign trade agreements and the “China plus one strategy" spotlight India as a beacon of reliability and diversification in the global supply chain. Post pandemic, India is poised to capitalise on shifting paradigms, offering a dependable alternative to traditional giants.”

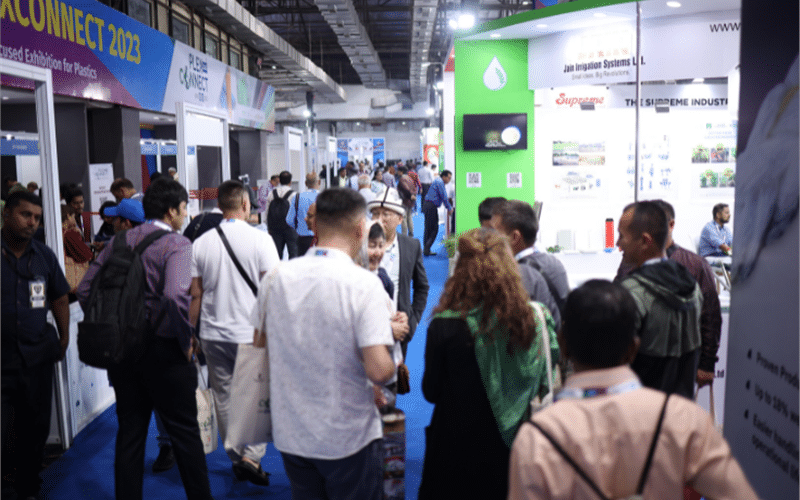

The inaugural edition of Plexconnect stands as a testament to India’s commitment to export-driven growth, drawing buyers from over 51 countries and fostering deals worth millions. Initiatives like Plexconnect, a dedicated platform for export-focused exhibitions, play a pivotal role in facilitating business opportunities and fostering international collaborations.

Looking ahead, Dasmohapatra shares his outlook for 2024. “The increasing demand in eCommerce, food packaging, pharmaceuticals, and consumer products for both flexible and rigid plastics indicates a rising trend towards the adoption of biodegradable alternatives, recyclable and recycled content, and innovative materials. This shift is expected to gain momentum in the upcoming years.”

From fostering SMEs to navigating international trade barriers, the industry embarks on a journey of transformation, guided by innovation, collaboration, and commitment to sustainability.

Plexconnect 2024 to double the international buyers to over 900

In a first, Plexconnect held in Mumbai in June 2023, generated USD 16.1 million worth of inquiries, and finalised deals worth USD 5.3 million. The second edition will take place from 7 to 9 June 2024 at Halls 2 and 3 of the Bombay Exhibition Centre (BEC); and expects 25,000 trade visitors. Plexconnect expects to double the international buyers to over 900, from over 100 countries, with over 700 registered buyers already.

In a first, Plexconnect held in Mumbai in June 2023, generated USD 16.1 million worth of inquiries, and finalised deals worth USD 5.3 million. The second edition will take place from 7 to 9 June 2024 at Halls 2 and 3 of the Bombay Exhibition Centre (BEC); and expects 25,000 trade visitors. Plexconnect expects to double the international buyers to over 900, from over 100 countries, with over 700 registered buyers already.

The three-day event offers exhibitors an exceptional platform to unveil their latest advancements in processing, machinery, moulds, dies, auxiliary equipment, printing and packaging, raw materials, and beyond.

“Plexconcil intends to bring MSMEs in particular, into the exporter fraternity and help them expand their global footprint. We expect much greater participation and further aim to bring unique buyers in the second edition as well to ensure wider benefit to our member exporters,” says Dasmohapatra.