Plexconcil shares plastic export trends for November 2023

The Plastics Export Promotion Council, Plexconcil has published an extensive report providing a thorough examination of the plastic export patterns in India for November 2023.

02 Jan 2024 | By Aditya Ghosalkar

The study based on data from the Ministry of Commerce & Industry, Government of India indicates that for November 2023 plastics exports witnessed a notable increase across key categories like laminates, FRP and composites, medical items of plastics and verticals such as consumer and houseware products, monofilaments, and plastic raw materials, decreased exports compared to November 2022.

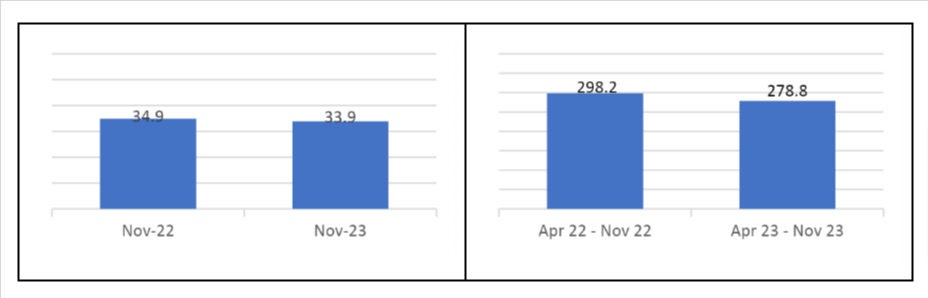

In November 2023, India recorded merchandise exports totalling USD 33.9-billion, reflecting a marginal decline of 2.8% compared to the same period in 2022. The cumulative value of merchandise exports from April to November 2023 stood at USD 278.8-billion, indicating a 6.5% dip from last year's corresponding period.

Trend in overall merchandise exports from India in USD million (Source: Ministry of Commerce & Industry, Government of India)

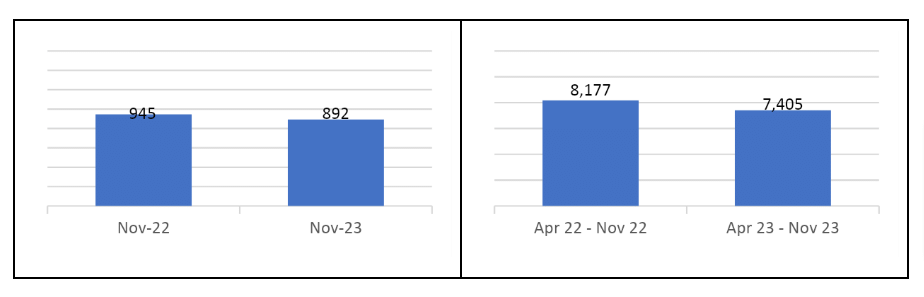

The plastic sector, a crucial component of India's export portfolio, declined in November 2023. Plastic exports amounted to USD 892-million, a 5.6% decrease from November 2022. The cumulative value of plastics exports from April to November 2023 was USD 7,405-million, registering a 9.4% decline compared to the same period in the previous year.

Trend in plastics export by India in USD million (Source: Ministry of Commerce & Industry, Government of India)

Hemant Minocha, chairman of Plexconcil, said, “October 2023 saw a 9.4% jump yoy in overall plastics exported from India. While we have witnessed a minor decline in November, I am positive about the bullish demand for Indian plastics in the international markets. We are particularly bullish about the South American continent, where we recently organised a strategic buyer-seller meet across Costa Rica, Guatemala, El Salvador and Guatemala.”

“A contingent of over 100 exporters from India successfully engaged with over 50 companies to discuss a fruitful way forward, enabling us to create export opportunities to over USD 100-million in the next four years. As we advance, we would closely identify opportunities across multiple countries to help boost India’s overall exports,” added Minocha.

In November 2023, the Indian export landscape witnessed diverse trends across various product categories. Consumer and houseware products faced a substantial decline of 14.8%, primarily attributed to reduced sales of household and toilet articles made of plastics, plastic moulded suitcases, handbags and toothbrushes.

The export of FIBC, woven sacks, woven fabrics and tarpaulin exhibited a marginal decline of 2.9%. This was primarily due to reduced sales of flexible intermediate bulk containers, particularly to the USA. The average price realisations for flexible intermediate bulk containers have seen a 17% decrease throughout the year.

Sribash Dasmohapatra, executive director, Plexconcil, said, “The Indian contingent in the recently concluded ArabPlast 2023 in Dubai was one of the biggest in recent years. The Middle East imported USD 38-billion of plastics in 2022, with India capturing a 4.7% share (USD 1.7-billion). It highlights the immense growth potential for Indian plastics in the region.”

“Plexconcil is committed to helping our members tap into this potential. It organised reverse buyer-seller meet (RBSM) with over 100 international buyers in a bid to support domestic industries and encourage a greater number of domestic processors into the export fold and benefit from increasing global opportunities,” added Dasmohapatra.

Packaging items, both flexible and rigid, experienced a modest increase of 1.9%, fueled by higher sales of boxes, cases, crates and similar articles for the conveyance or packaging of goods, made of plastics, and sacks and bags of plastics. India predominantly exports packaging items - flexible, and rigid to North America and Europe.

The export of plastic films and sheets saw a decline of 2.3% in November 2023, driven by reduced sales of films and sheets of polycarbonates, films and sheets of polyethene terephthalate, and films and sheets of other polyesters. Nonetheless, Indian exporters of plastic films and sheets have indicated signs of improvement in the export market since the end of the June 2023 quarter, with demand for BOPP starting to recover.

Plastic raw materials exports declined by 14.5% in November 2023, attributed to lower sales of polypropylene, polytetrafluoroethylene and polyethylene terephthalate. The average price realisations for polypropylene and polyethylene terephthalate have fallen by 15-20% throughout the year, positioning India among the top-five exporters of polytetrafluoroethylene and polyethylene terephthalate resin globally.