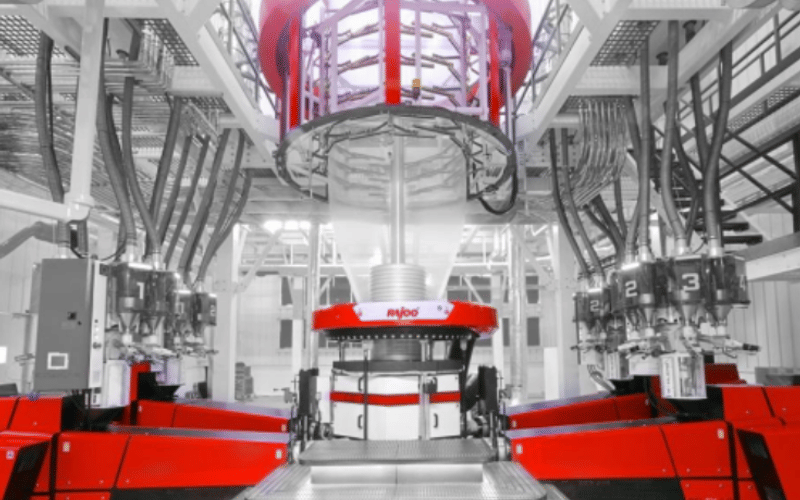

Rajoo Engineers raises 160-crore via QIP to fuel expansion plans

The QIP involved the issue of 1,46,78,900 equity shares at INR 109 per share (face value INR 1), and closed on 21 July.

28 Jul 2025 | By Sai Deepthi P

Plastic extrusion machinery manufacturer Rajoo Engineers has raised INR 160-crore through a Qualified Institutional Placement (QIP), citing strong interest from both domestic and international investors.

The QIP involved the issue of 1,46,78,900 equity shares at INR 109 per share (face value INR 1), and closed on 21 July.

Following the issue, Foreign Institutional Investor (FII) holding increased to 3.8%, while Domestic Institutional Investor (DII) holding rose to 4.46%.

Institutional participants in the offering included Morgan Stanley Asia (Singapore), HDFC Bank, Rajasthan Global Securities, Moneywise Financial Services, Credit Access Life Insurance, and BNP Paribas Financial Markets – ODI.

“This fundraise is an important milestone for us,” said Khushboo Doshi, managing director of Rajoo Engineers. “We will use this capital to scale up our operations and deliver long-term value to stakeholders.”

The company intends to use the proceeds for strategic acquisitions, aiming to drive inorganic growth, expand its product portfolio, and strengthen its market presence.

Following this, Rajoo Engineers signed a non-binding indicative offer to acquire a company engaged in the manufacture of machinery for multiple industries. The target company, which has operated for over three decades, is known for its strong brand and has an established presence in both domestic and international markets. Financial details of the proposed deal have not been disclosed.

According to the filing, the move aligns with Rajoo Engineers’ strategy for inorganic growth through forward integration. The potential acquisition is expected to generate synergies that will allow the company to offer end-to-end solutions across the value chain, thereby strengthening its market position.